The end of the financial year is here already! It seems that so little time has passed since we welcomed in 2023. As we approach EOFY, we invite you to reflect on the last year. So much has happened in the previous year that we are still catching up with – more clients are expecting remote and fast turnaround services, cashflow planning continues to rise, the growing importance of sustainability reporting and the explosion of artificial intelligence tools such as ChatGPT.

Take some time to celebrate your successes and learn from challenges. What trials has your business overcome in the last year? What are you looking forward to?

One thing is for sure – the accounting industry has seen significant changes in recent years, and it’s not slowing down! Having sound systems and the right tools to support your practice is essential to staying sane and productive in these fast-moving times.

The end of the financial year is busy – but also a great time to assess your systems in preparation for the coming financial year. Do you need to upgrade systems? Are there areas of your practice you can simplify? Do you need to start documenting checklists and workflows?

As tax professionals, we understand the responsibility and stress that working in this industry often demands. With our practice management tools, integrated ATO services, digital authentication and highest security, we want to support your practice to be the best it can be. So let us know how GovReports can help your workload be more organised!

The accounting and small business industry will continue to evolve, and accounting professionals must be prepared to adapt to the emerging and continually changing landscape.

Introducing HubeX – Our Exciting New Tax Return App

HubeX is our latest creative project – and one we hope will be really useful for you! HubeX makes it easier than ever to complete personal tax returns online quickly.

As a tax professional, you can invite existing clients to HubeX or connect to new clients through the platform.

Verify your clients’ identity in minutes, securely share all documents needed for the tax return, communicate with clients via a dedicated channel and get paid the day after lodgement is completed.

If you’re looking for new ways to collaborate with clients and streamline your individual tax return process, we think you’ll love HubeX – check out the information on becoming a service provider.

New Activity Statement Coming!

The ATO is updating the activity statement for the first time in many years. We are working closely with the ATO and all accounting software providers to ensure a smooth transition to the new activity statement.

W1 and W2 fields will be prefilled with data lodged from STP filed events. Of course, you can override these default amounts if needed.

We’ll let you know more details when we are closer to releasing the new functionality in GovReports.

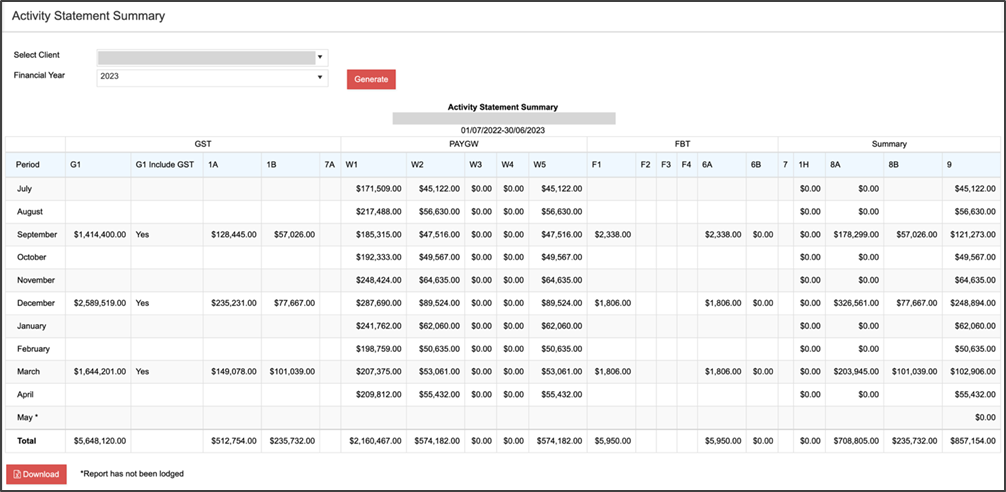

Activity Statement Summary Report

Have you tried the activity statement summary report yet?

EOY reconciliations become much quicker using this report. For example, run a report per client per financial year to see amounts previously lodged and check this against current reporting in your accounting software.

Use the Integrated Client Account report in conjunction with the Activity Statement Summary to reconcile lodgements and payments.

Save the report in your client file to easily verify lodged amounts without visiting the ATO.

Need a Simple Solution for STP Reporting?

Convenient, cost-effective and easy to use, our IAM STP Reporting Module is perfect for businesses with small or straightforward payrolls that need a standalone STP app. We understand many accountants look for simple STP solutions at this time of year, either to lodge pay events for the 2023 financial year or to get set up in readiness for the following year. Enter pay run details manually or import from a CSV file, roll over previous pay runs, and see at a glance the status of pay events, including final event indicators.

Talk to us on 1300 65 25 90 about our EOFY special offers!

Single Touch Payroll Phase 2 Finalisation

Single Touch Payroll finalisation for the financial year must be completed by Friday, 14 July 2023.

Once the STP finalisation has been sent to the ATO, the employee’s information will be released in their myGov account and listed as ‘tax ready’.

Finalisation in STP V2 is simply a matter of preparing the final pay event for the year and ticking the ‘Final Event Indicator’ box.

Remember to check the Payroll Summary, Payroll Transaction Journals and Superannuation Summary to reports from your accounting system to verify the amounts being finalised and sent to the ATO.

Subscribe through your practice on behalf of your clients and get a wholesale rate.

PAYG Payment Summary Annual Report (PSAR)

For any payments made to employees or contractors that have not been reported via STP, payment summaries still need to be issued by 14 July, and the payment summary annual report must be submitted to the ATO by 14 August.

You may need to report payments such as those for closely held payees, contractors with a voluntary withholding agreement, contractors for whom no ABN withholding applies or royalties. These payment summaries call all be prepared and lodged with GovReports.

Digital Authentication V2 From 1 July 2023

We are retiring the old version of Digital Authentication from GovReports on 30 June 2023. If you’ve not yet tried the DAv2, please go ahead and try it now. All your saved messages will be automatically available in the new version.

The upgraded DAv2 uses the latest technology for improved functionality, better security, and a more accessible interface.

You’ll find it easier to sign and send multiple documents, add more fields for authentication, and choose how clients authorise documents.

Your GovReports subscription already includes access to digital authentication. There’s no reason not to use it for every signature you need! Make it easy for your clients to sign authorisations prior to lodgement. You no longer need to wait around for clients to print, sign and scan signatures before you can lodge their forms. DAv2 makes it easy for your clients to approve lodgement, and you’ll always have an audit trail of documents sent and signed.

GovReports Blog and Webinars

You can check our blog and webinars for detailed information about this article’s topics. And don’t forget the Help Centre for user guides on all aspects of setting up and using GovReports.

We wish you well for the end of the financial year!

GovReports Team