We are rolling out Single Touch Payroll Phase 2!

All employers have to report STP pay events for all employees and closely held payees from July 2021.

The ATO STP Phase 2 was initially planned to start on 1 July 2021 with the compulsory reporting, however, it has been postponed to 1 January 2022 because of COVID-19 impacts on business and software providers.

GovReports nevertheless has developed the Phase 2 reporting capacity = and it’s ready to go now.

What’s Changed?

Single Touch Payroll Phase 2 includes more reporting categories and detailed payroll information.

Phase 2 allows employers to report to multiple government agencies via STP using standardised categories, making it easier for employees to interact with Services Australia and ensuring accuracy of data provided to the agency.

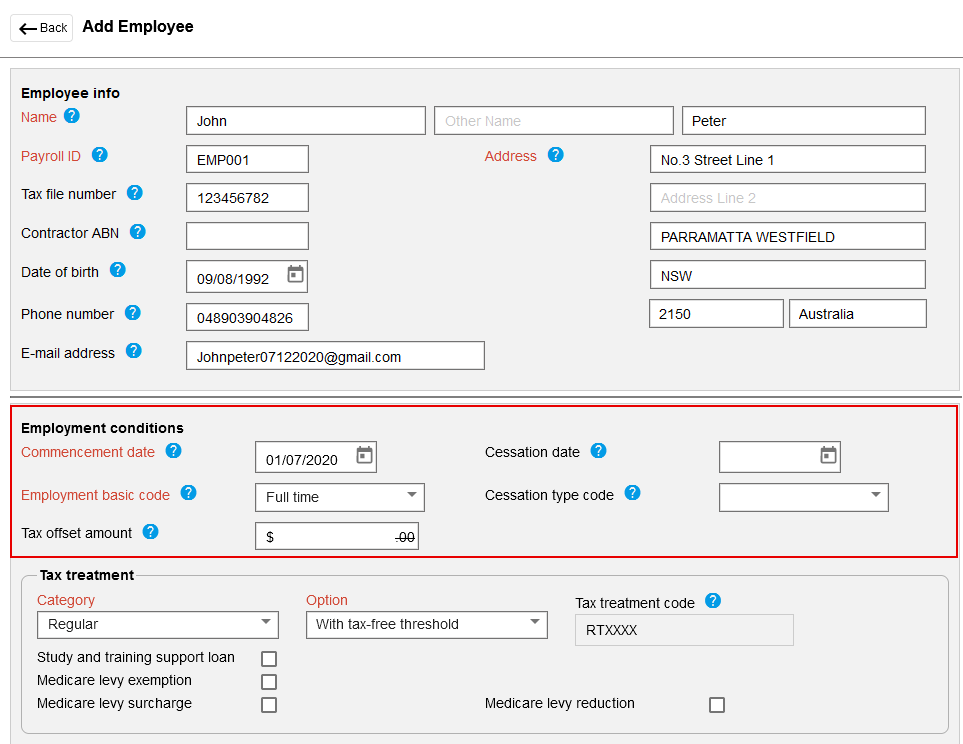

- Employment conditions – tax file numbers will be automatically filed with the ATO when you submit a report that includes a new employee. No need to lodge TFN declarations separately, as all the tax details are included. There will also be the ability to include the reason for termination, meaning employees will no longer need to get employment separation certificates from employers.

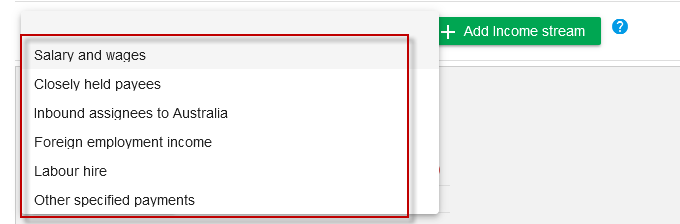

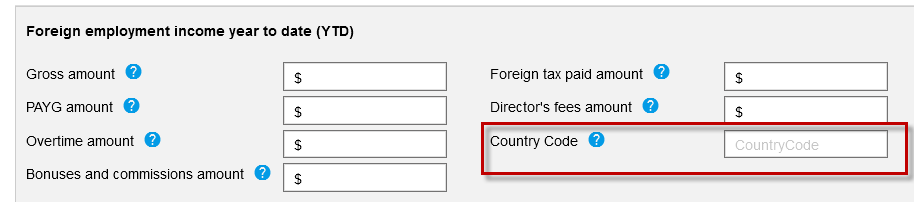

- Income type and country code – these codes will identify payments that require specific tax treatment, concessional reporting arrangements (for example, closely held payees), and the home country of the employee and relevant tax implications.

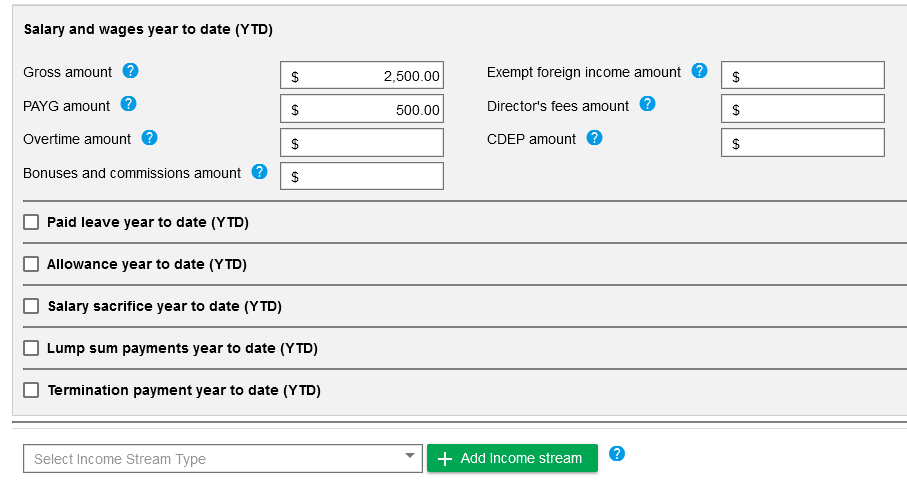

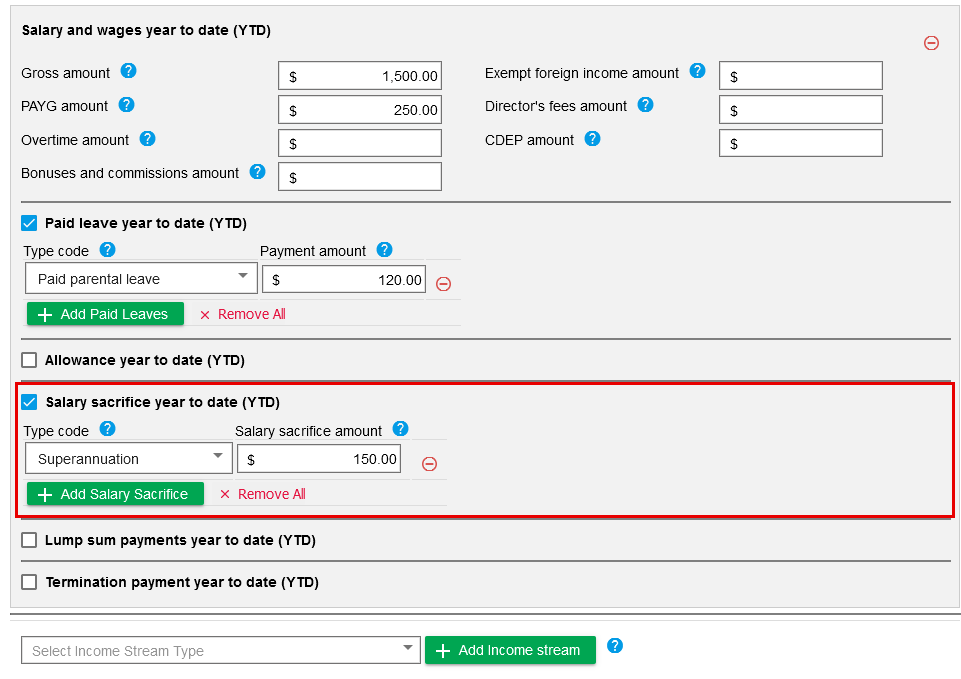

- Disaggregation of gross – the current STP report submits gross amount without differentiation into different components. STP Phase 2 will report the separate components of gross payments into dedicated categories: bonus or commission, director fees, paid leave, salary sacrifice, overtime, allowances and other gross payments. All allowances will be reported separately in Phase 2.

- Salary sacrifice – amounts sacrificed to superannuation will be reported separately, making it easier for employees to understand the superannuation guarantee amount as distinct from salary sacrifice amounts.

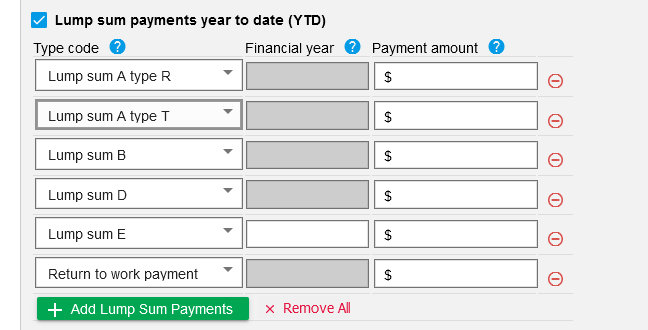

- Lump sums – lump sum E payments will include an indicator for financial year. There is a new lump sum W category, which is a return-to-work payment taxed concessionally, but which used to be reported in gross wages.

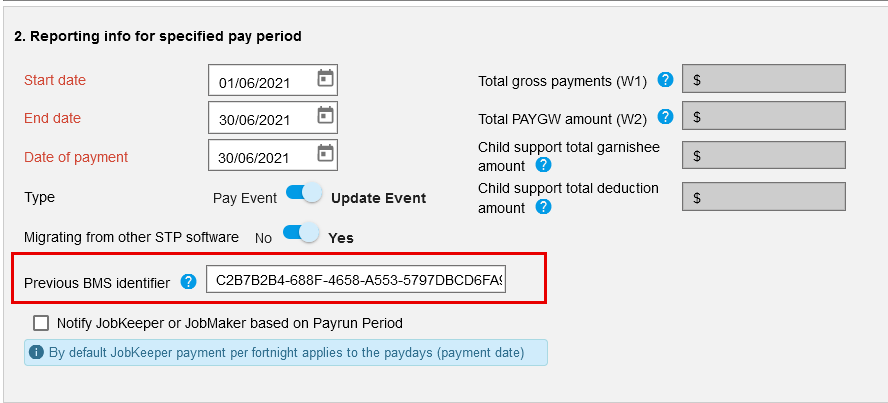

- Reporting previous BMS IDs and Payroll IDs – if a business has changed business management software or internal payroll identification numbers, this information can now be submitted with STP reports to reduce the occurrence of duplicate income statements for employees and bring STP into line with current payroll IDs.

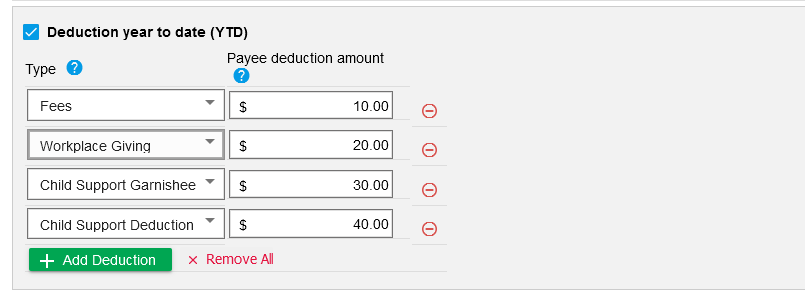

- Child support garnishees and deductions – these amounts will now be reported in STP and provided to the child support registrar, eliminating the need for separate reporting to this agency.

All the current functions of Single Touch Payroll reporting continue unchanged. The system is expanding in the scope of reporting but essentially remains unchanged in how you report using GovReports.

STP Phase 2 in GovReports

GovReports is ready now for employers to swap to Phase 2 reporting. The ATO can accept the expanded data – we recommend you transition now from GovReports V1 to V2 and get ahead of the curve.

There is no reason not to upgrade to STP V2 straight away; however, if you prefer you can stay on V1 until it becomes mandatory to move to V2.

Once you upgrade to V2 in GovReports it is irreversible!

GovReports STP V2 still provides all the functions you know and love: the option to upload CSV files or manually enter payroll data, failure notifications, the ability to update events and copy pay templates and ability to include contractor ABNs.

Other Upgrades

In addition to STP V2 reporting requirements, we’ve made a few other improvements:

- Included option to migrate from other STP software.

- BMS and Payroll IDs are not compulsory for software providers to include in Phase 2, but GovReports has included this important data in our upgrade to minimise errors and duplication.

- Clarified Employment Termination Payment (ETP) benefit types and codes so it’s easier to choose the correct ETP code.

- Ability to add extra fields as required: superannuation, salary sacrifice, Reportable Fringe Benefits Amounts, income streams, termination payments and allowances.

- Improved layout of STP sections and fields.

We look forward to hearing how you like Single Touch Payroll V 2 in GovReports – let us know your feedback!

A Webinar was presented by Deborah Thompson on Thursday 29 April focusing on STP for closely held payees with a sneak preview of STP V2 to be released on July 1. You can Watch the recording here.